The Solar-Powered Mortgage

Here, I continue the solar-powered life hack series with "The Solar-Powered Mortgage." It's a bit of an awkward one for me because money is a taboo subject. But on the other hand, this story is just too cool to pass up.As a recent home buyer in the Bay Area, I can attest to the unbelievably high cost of housing here. Paying the mortgage is by far my biggest monthly expense. Meanwhile, I'm a diehard "Boglehead" investor who believes in investing in passive index funds to partially support my lifestyle. While this strategy most certainly works over the long haul, in the short term it can make for a very bumpy ride. So I found myself in search of a strategy to smooth the ride (and one that would return more than bonds these days). Enter commercial solar. Solar has undergone a boom over the last several years, with residential and utility-scale solar each increasing by over 500% between 2012-2016:Why has commercial solar lagged behind? I'm not entirely sure, but one reason could be the awkward size of the loans commercial entities seek. Here we're talking about small businesses, non-profits, school districts and the like. The Apples, Googles and Wal-Mart's of the world have plenty of capital to buy solar outright just like those in the residential sector. Imagine being the CFO of a small business and deciding if you're going to purchase a solar system for $350,000 with a payback time of 5-7 years. It's just not going to happen. And for whatever reason, conventional lenders have been sluggish in this space, leaving room for disruption.Wunder Capital found a way to package solar loans in an attractive way for both lenders and borrowers. Here's how it works:Borrowers get the money they need for their system with no money down. Well technically, they put 30% down as they get to claim the 30% federal tax credit. Free money! Then they pay down their loan at a 7.5% rate over a 20 year amortization term. Investors (like me) get a 7.5% return on their investment in the form of monthly direct deposits for five years, when they're due a balloon payment. At this point, borrowers would likely refinance and continue to pay down their solar loans. Also, importantly, investors get diversification from the entire portfolio of loans (currently hundreds of projects located in 37 states).Before we go on: what is the risk of this investment? Well, these are real solar installations, producing energy tied to the US grid. So as long as the panels themselves are producing and there is a power consumer under that rooftop, the investments will pay. Where things get dicey is if a borrower goes out of business and then no one occupies their building for an extended period. Fortunately, I think diversification helps greatly with this, though as with all investments there are risks.Being the type of guy who optimizes things in Excel for fun, I set out to calculate the exact amount needed to offset my mortgage payment. So how much do you need to have a solar-powered mortgage? Well, the numbers depend on your interest rates, size of your down payment and many other details. But in my case, I made approximately a 35% down payment and a 35% investment in Wunder to be completely free of my mortgage burden. I actually oversized my investment to 50% to cover property taxes, insurance and a little extra. Essentially for a double down payment, and significantly less than paying cash for a house, I get to live in my house for free while building equity on autopilot. And of course, it's possible to do this with smaller numbers and still get the benefits of a high yield bond-like investment in commercial solar.But it's not all about the money. There are significant environmental offsets from such a large investment in renewable energy. Here's my progress report after a few months:

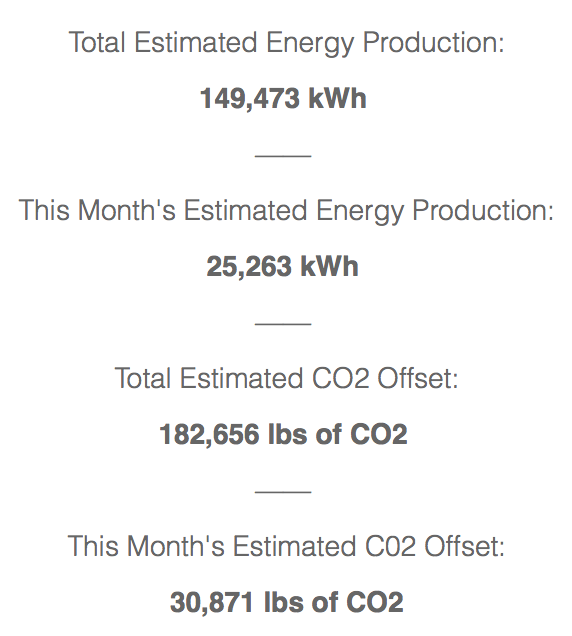

Enter commercial solar. Solar has undergone a boom over the last several years, with residential and utility-scale solar each increasing by over 500% between 2012-2016:Why has commercial solar lagged behind? I'm not entirely sure, but one reason could be the awkward size of the loans commercial entities seek. Here we're talking about small businesses, non-profits, school districts and the like. The Apples, Googles and Wal-Mart's of the world have plenty of capital to buy solar outright just like those in the residential sector. Imagine being the CFO of a small business and deciding if you're going to purchase a solar system for $350,000 with a payback time of 5-7 years. It's just not going to happen. And for whatever reason, conventional lenders have been sluggish in this space, leaving room for disruption.Wunder Capital found a way to package solar loans in an attractive way for both lenders and borrowers. Here's how it works:Borrowers get the money they need for their system with no money down. Well technically, they put 30% down as they get to claim the 30% federal tax credit. Free money! Then they pay down their loan at a 7.5% rate over a 20 year amortization term. Investors (like me) get a 7.5% return on their investment in the form of monthly direct deposits for five years, when they're due a balloon payment. At this point, borrowers would likely refinance and continue to pay down their solar loans. Also, importantly, investors get diversification from the entire portfolio of loans (currently hundreds of projects located in 37 states).Before we go on: what is the risk of this investment? Well, these are real solar installations, producing energy tied to the US grid. So as long as the panels themselves are producing and there is a power consumer under that rooftop, the investments will pay. Where things get dicey is if a borrower goes out of business and then no one occupies their building for an extended period. Fortunately, I think diversification helps greatly with this, though as with all investments there are risks.Being the type of guy who optimizes things in Excel for fun, I set out to calculate the exact amount needed to offset my mortgage payment. So how much do you need to have a solar-powered mortgage? Well, the numbers depend on your interest rates, size of your down payment and many other details. But in my case, I made approximately a 35% down payment and a 35% investment in Wunder to be completely free of my mortgage burden. I actually oversized my investment to 50% to cover property taxes, insurance and a little extra. Essentially for a double down payment, and significantly less than paying cash for a house, I get to live in my house for free while building equity on autopilot. And of course, it's possible to do this with smaller numbers and still get the benefits of a high yield bond-like investment in commercial solar.But it's not all about the money. There are significant environmental offsets from such a large investment in renewable energy. Here's my progress report after a few months: These are some pretty big numbers. The size of my investment is roughly 80 times bigger than the solar I had installed on my own roof. And many of the projects are in even better locations than my house with respect to the solar resource. This investment absolutely dwarfs my carbon footprint. Assuming a carbon footprint of 20 metric tons of CO2 / year for the average American, this investment offsets the carbon footprint of around 10 Americans! And it creates about 4 jobs in the US solar industry!While there are countless ways to help the environment or earn a decent return on investment, this way makes it ridiculously easy to do both. I want to help fix climate change as much as the next climate scientist / alpine climber, but investment in commercial solar incentivized me to do so at a much bigger scale than I otherwise would have done.If it sounds too good to be true, ask yourself: what about free unlimited power from the sun is too good to be true? We need all the help we can get accelerating the transition to renewable energy. Now, don't you want a solar-powered mortgage?

These are some pretty big numbers. The size of my investment is roughly 80 times bigger than the solar I had installed on my own roof. And many of the projects are in even better locations than my house with respect to the solar resource. This investment absolutely dwarfs my carbon footprint. Assuming a carbon footprint of 20 metric tons of CO2 / year for the average American, this investment offsets the carbon footprint of around 10 Americans! And it creates about 4 jobs in the US solar industry!While there are countless ways to help the environment or earn a decent return on investment, this way makes it ridiculously easy to do both. I want to help fix climate change as much as the next climate scientist / alpine climber, but investment in commercial solar incentivized me to do so at a much bigger scale than I otherwise would have done.If it sounds too good to be true, ask yourself: what about free unlimited power from the sun is too good to be true? We need all the help we can get accelerating the transition to renewable energy. Now, don't you want a solar-powered mortgage?

The Ultimate Solar-Powered Life Hack

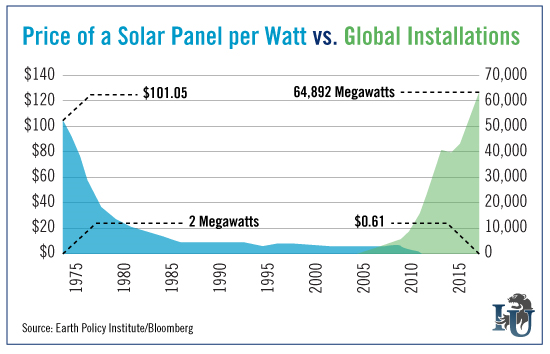

I've recently been taking a number of steps to convert my fossil fuel intensive lifestyle into one characterized by abundant clean energy. In a series of posts, I'll attempt to lay out the case for renewables and how I'm incorporating them into my housing, transportation and investment portfolio.Ever since I started learning about energy and climate change, it's been a mostly depressing story. In short, we're consuming too much carbon-intensive energy and there doesn't seem to be an end in sight. Indeed, renewable energy such as solar, wind and geothermal in the US is dwarfed by our reliance on fossil fuels: And the reason was quite simple: fossil fuels were the cheapest sources of energy available. If only the price of carbon (or human health) were incorporated into capitalism, we lamented, the system would help us choose the right energy sources. Well, things are starting to change in a way that makes the case for renewable energy a whole lot easier:

And the reason was quite simple: fossil fuels were the cheapest sources of energy available. If only the price of carbon (or human health) were incorporated into capitalism, we lamented, the system would help us choose the right energy sources. Well, things are starting to change in a way that makes the case for renewable energy a whole lot easier: Solar and other renewables are starting to compete on price alone with fossil fuels in many markets! Since 2009, wind power has decreased by 67% and solar has decreased by 85% (ACORE). So Michelle and I obviously wanted to see how things shook out for our new house. In short, our house was ideal, sporting a large shade-free west facing roof as well as a row of clerestory windows to let in natural light but not the heat: classic passive solar design.

Solar and other renewables are starting to compete on price alone with fossil fuels in many markets! Since 2009, wind power has decreased by 67% and solar has decreased by 85% (ACORE). So Michelle and I obviously wanted to see how things shook out for our new house. In short, our house was ideal, sporting a large shade-free west facing roof as well as a row of clerestory windows to let in natural light but not the heat: classic passive solar design. Breaking down the economics, we're able to produce energy at ~ 7 cents/kWh as opposed to more like 33 cents/kWh retail. Using very conservative assumptions for things like inflation gives us a true, tax-free return on investment over 25 years of 15.8% and a payback period of 6.2 years. So how did things turn out? The results of our PV array were immediately visible:

Breaking down the economics, we're able to produce energy at ~ 7 cents/kWh as opposed to more like 33 cents/kWh retail. Using very conservative assumptions for things like inflation gives us a true, tax-free return on investment over 25 years of 15.8% and a payback period of 6.2 years. So how did things turn out? The results of our PV array were immediately visible:

We produce more energy than we consume, making this a "positive energy home." There are two places we send our excess energy...to the grid (for 2.75 cents/kWh) and...to free clean transportation.

We produce more energy than we consume, making this a "positive energy home." There are two places we send our excess energy...to the grid (for 2.75 cents/kWh) and...to free clean transportation. Adding an electric vehicle to the mix makes the payback time of 6.2 years above likely more like 3-4 years considering I spent over $1500 on gas last year.

Adding an electric vehicle to the mix makes the payback time of 6.2 years above likely more like 3-4 years considering I spent over $1500 on gas last year.