The Solar-Powered Mortgage

Here, I continue the solar-powered life hack series with "The Solar-Powered Mortgage." It's a bit of an awkward one for me because money is a taboo subject. But on the other hand, this story is just too cool to pass up.As a recent home buyer in the Bay Area, I can attest to the unbelievably high cost of housing here. Paying the mortgage is by far my biggest monthly expense. Meanwhile, I'm a diehard "Boglehead" investor who believes in investing in passive index funds to partially support my lifestyle. While this strategy most certainly works over the long haul, in the short term it can make for a very bumpy ride. So I found myself in search of a strategy to smooth the ride (and one that would return more than bonds these days). Enter commercial solar. Solar has undergone a boom over the last several years, with residential and utility-scale solar each increasing by over 500% between 2012-2016:Why has commercial solar lagged behind? I'm not entirely sure, but one reason could be the awkward size of the loans commercial entities seek. Here we're talking about small businesses, non-profits, school districts and the like. The Apples, Googles and Wal-Mart's of the world have plenty of capital to buy solar outright just like those in the residential sector. Imagine being the CFO of a small business and deciding if you're going to purchase a solar system for $350,000 with a payback time of 5-7 years. It's just not going to happen. And for whatever reason, conventional lenders have been sluggish in this space, leaving room for disruption.Wunder Capital found a way to package solar loans in an attractive way for both lenders and borrowers. Here's how it works:Borrowers get the money they need for their system with no money down. Well technically, they put 30% down as they get to claim the 30% federal tax credit. Free money! Then they pay down their loan at a 7.5% rate over a 20 year amortization term. Investors (like me) get a 7.5% return on their investment in the form of monthly direct deposits for five years, when they're due a balloon payment. At this point, borrowers would likely refinance and continue to pay down their solar loans. Also, importantly, investors get diversification from the entire portfolio of loans (currently hundreds of projects located in 37 states).Before we go on: what is the risk of this investment? Well, these are real solar installations, producing energy tied to the US grid. So as long as the panels themselves are producing and there is a power consumer under that rooftop, the investments will pay. Where things get dicey is if a borrower goes out of business and then no one occupies their building for an extended period. Fortunately, I think diversification helps greatly with this, though as with all investments there are risks.Being the type of guy who optimizes things in Excel for fun, I set out to calculate the exact amount needed to offset my mortgage payment. So how much do you need to have a solar-powered mortgage? Well, the numbers depend on your interest rates, size of your down payment and many other details. But in my case, I made approximately a 35% down payment and a 35% investment in Wunder to be completely free of my mortgage burden. I actually oversized my investment to 50% to cover property taxes, insurance and a little extra. Essentially for a double down payment, and significantly less than paying cash for a house, I get to live in my house for free while building equity on autopilot. And of course, it's possible to do this with smaller numbers and still get the benefits of a high yield bond-like investment in commercial solar.But it's not all about the money. There are significant environmental offsets from such a large investment in renewable energy. Here's my progress report after a few months:

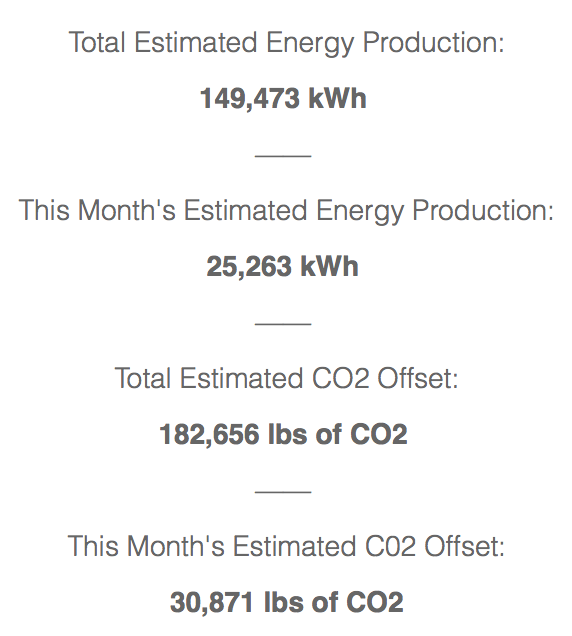

Enter commercial solar. Solar has undergone a boom over the last several years, with residential and utility-scale solar each increasing by over 500% between 2012-2016:Why has commercial solar lagged behind? I'm not entirely sure, but one reason could be the awkward size of the loans commercial entities seek. Here we're talking about small businesses, non-profits, school districts and the like. The Apples, Googles and Wal-Mart's of the world have plenty of capital to buy solar outright just like those in the residential sector. Imagine being the CFO of a small business and deciding if you're going to purchase a solar system for $350,000 with a payback time of 5-7 years. It's just not going to happen. And for whatever reason, conventional lenders have been sluggish in this space, leaving room for disruption.Wunder Capital found a way to package solar loans in an attractive way for both lenders and borrowers. Here's how it works:Borrowers get the money they need for their system with no money down. Well technically, they put 30% down as they get to claim the 30% federal tax credit. Free money! Then they pay down their loan at a 7.5% rate over a 20 year amortization term. Investors (like me) get a 7.5% return on their investment in the form of monthly direct deposits for five years, when they're due a balloon payment. At this point, borrowers would likely refinance and continue to pay down their solar loans. Also, importantly, investors get diversification from the entire portfolio of loans (currently hundreds of projects located in 37 states).Before we go on: what is the risk of this investment? Well, these are real solar installations, producing energy tied to the US grid. So as long as the panels themselves are producing and there is a power consumer under that rooftop, the investments will pay. Where things get dicey is if a borrower goes out of business and then no one occupies their building for an extended period. Fortunately, I think diversification helps greatly with this, though as with all investments there are risks.Being the type of guy who optimizes things in Excel for fun, I set out to calculate the exact amount needed to offset my mortgage payment. So how much do you need to have a solar-powered mortgage? Well, the numbers depend on your interest rates, size of your down payment and many other details. But in my case, I made approximately a 35% down payment and a 35% investment in Wunder to be completely free of my mortgage burden. I actually oversized my investment to 50% to cover property taxes, insurance and a little extra. Essentially for a double down payment, and significantly less than paying cash for a house, I get to live in my house for free while building equity on autopilot. And of course, it's possible to do this with smaller numbers and still get the benefits of a high yield bond-like investment in commercial solar.But it's not all about the money. There are significant environmental offsets from such a large investment in renewable energy. Here's my progress report after a few months: These are some pretty big numbers. The size of my investment is roughly 80 times bigger than the solar I had installed on my own roof. And many of the projects are in even better locations than my house with respect to the solar resource. This investment absolutely dwarfs my carbon footprint. Assuming a carbon footprint of 20 metric tons of CO2 / year for the average American, this investment offsets the carbon footprint of around 10 Americans! And it creates about 4 jobs in the US solar industry!While there are countless ways to help the environment or earn a decent return on investment, this way makes it ridiculously easy to do both. I want to help fix climate change as much as the next climate scientist / alpine climber, but investment in commercial solar incentivized me to do so at a much bigger scale than I otherwise would have done.If it sounds too good to be true, ask yourself: what about free unlimited power from the sun is too good to be true? We need all the help we can get accelerating the transition to renewable energy. Now, don't you want a solar-powered mortgage?

These are some pretty big numbers. The size of my investment is roughly 80 times bigger than the solar I had installed on my own roof. And many of the projects are in even better locations than my house with respect to the solar resource. This investment absolutely dwarfs my carbon footprint. Assuming a carbon footprint of 20 metric tons of CO2 / year for the average American, this investment offsets the carbon footprint of around 10 Americans! And it creates about 4 jobs in the US solar industry!While there are countless ways to help the environment or earn a decent return on investment, this way makes it ridiculously easy to do both. I want to help fix climate change as much as the next climate scientist / alpine climber, but investment in commercial solar incentivized me to do so at a much bigger scale than I otherwise would have done.If it sounds too good to be true, ask yourself: what about free unlimited power from the sun is too good to be true? We need all the help we can get accelerating the transition to renewable energy. Now, don't you want a solar-powered mortgage?