The Ultimate Solar-Powered Life Hack

I've recently been taking a number of steps to convert my fossil fuel intensive lifestyle into one characterized by abundant clean energy. In a series of posts, I'll attempt to lay out the case for renewables and how I'm incorporating them into my housing, transportation and investment portfolio.Ever since I started learning about energy and climate change, it's been a mostly depressing story. In short, we're consuming too much carbon-intensive energy and there doesn't seem to be an end in sight. Indeed, renewable energy such as solar, wind and geothermal in the US is dwarfed by our reliance on fossil fuels: And the reason was quite simple: fossil fuels were the cheapest sources of energy available. If only the price of carbon (or human health) were incorporated into capitalism, we lamented, the system would help us choose the right energy sources. Well, things are starting to change in a way that makes the case for renewable energy a whole lot easier:

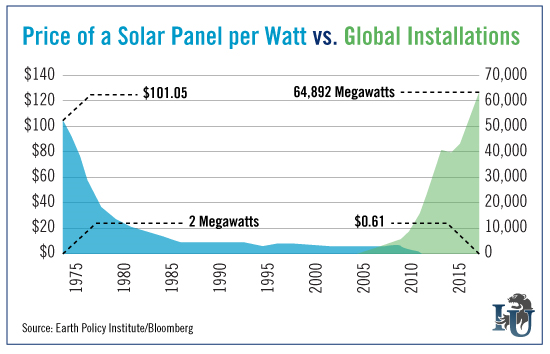

And the reason was quite simple: fossil fuels were the cheapest sources of energy available. If only the price of carbon (or human health) were incorporated into capitalism, we lamented, the system would help us choose the right energy sources. Well, things are starting to change in a way that makes the case for renewable energy a whole lot easier: Solar and other renewables are starting to compete on price alone with fossil fuels in many markets! Since 2009, wind power has decreased by 67% and solar has decreased by 85% (ACORE). So Michelle and I obviously wanted to see how things shook out for our new house. In short, our house was ideal, sporting a large shade-free west facing roof as well as a row of clerestory windows to let in natural light but not the heat: classic passive solar design.

Solar and other renewables are starting to compete on price alone with fossil fuels in many markets! Since 2009, wind power has decreased by 67% and solar has decreased by 85% (ACORE). So Michelle and I obviously wanted to see how things shook out for our new house. In short, our house was ideal, sporting a large shade-free west facing roof as well as a row of clerestory windows to let in natural light but not the heat: classic passive solar design. Breaking down the economics, we're able to produce energy at ~ 7 cents/kWh as opposed to more like 33 cents/kWh retail. Using very conservative assumptions for things like inflation gives us a true, tax-free return on investment over 25 years of 15.8% and a payback period of 6.2 years. So how did things turn out? The results of our PV array were immediately visible:

Breaking down the economics, we're able to produce energy at ~ 7 cents/kWh as opposed to more like 33 cents/kWh retail. Using very conservative assumptions for things like inflation gives us a true, tax-free return on investment over 25 years of 15.8% and a payback period of 6.2 years. So how did things turn out? The results of our PV array were immediately visible:

We produce more energy than we consume, making this a "positive energy home." There are two places we send our excess energy...to the grid (for 2.75 cents/kWh) and...to free clean transportation.

We produce more energy than we consume, making this a "positive energy home." There are two places we send our excess energy...to the grid (for 2.75 cents/kWh) and...to free clean transportation. Adding an electric vehicle to the mix makes the payback time of 6.2 years above likely more like 3-4 years considering I spent over $1500 on gas last year.

Adding an electric vehicle to the mix makes the payback time of 6.2 years above likely more like 3-4 years considering I spent over $1500 on gas last year.